Key Takeaways

A ULIP combines life insurance with market-linked investment, offering long-term wealth creation along with protection. Premiums are split between insurance cover and selected funds, with a mandatory 5-year lock-in. Returns depend on market performance. Tax benefits may apply as per prevailing laws. Understanding charges, risks, and policy terms is essential.

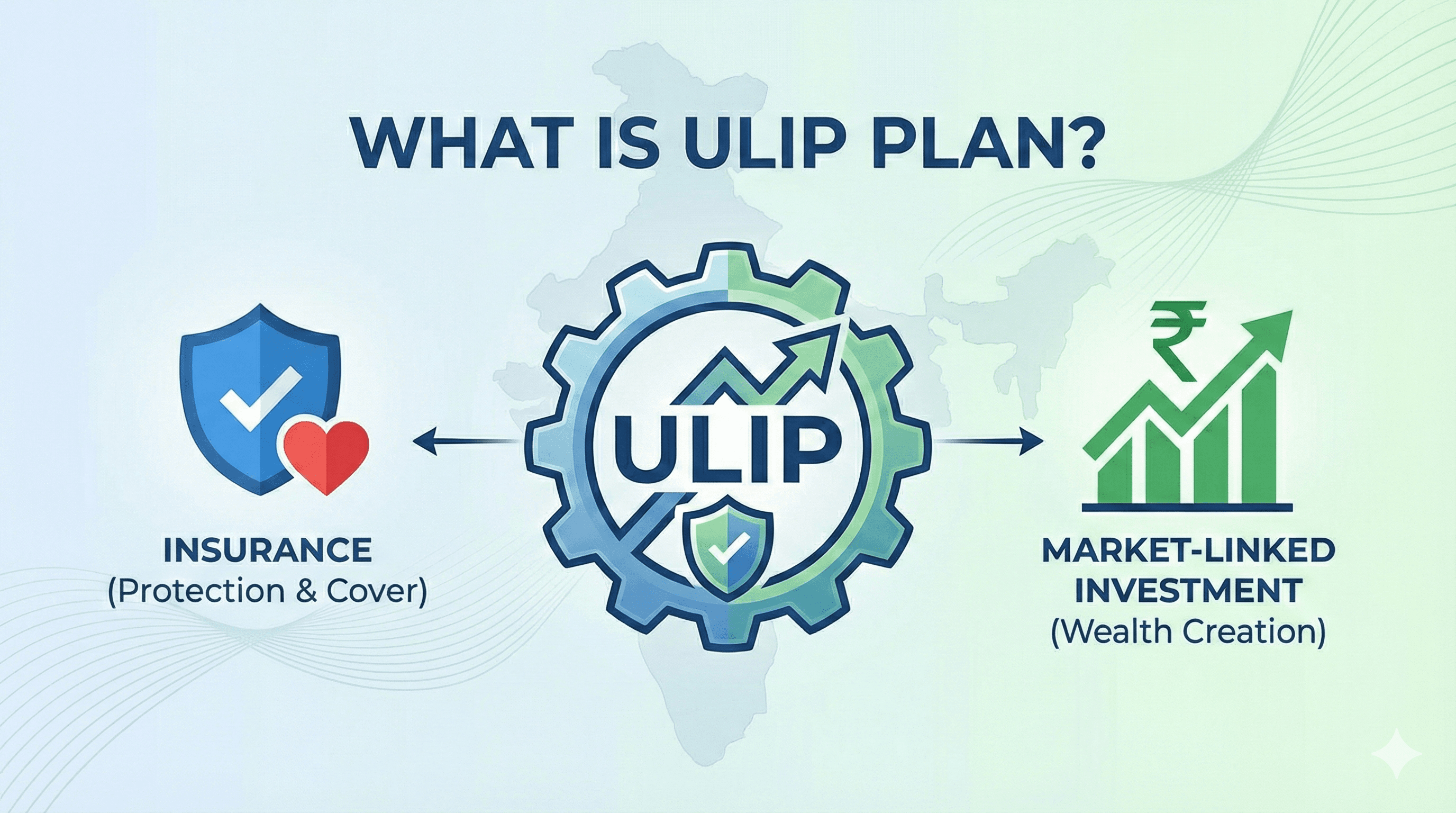

A Unit Linked Insurance Plan (ULIP) is a life insurance product that provides life cover along with a market-linked investment component. The ULIP policy is designed for individuals who are looking for long-term financial planning along with insurance protection. In this blog we will understand the working mechanism of this insurance plan and the reason why you may consider it.

What Is ULIP?

ULIP stands for Unit Linked Insurance Plan. When you pay a premium:

- A portion of it goes towards life insurance coverage (mortality charges).

- The remaining amount, after applicable charges, is invested in funds chosen by you.

The funds in which part of the ULIP premium is invested include equity, debt, or balanced options, depending on the insurer's offerings. The value of your investment depends on the performance of the underlying funds and Net Asset Value (NAV), which fluctuates based on market conditions.

How Does It Work?

Premium Payment: The ULIP policy starts with your premium payment as per the chosen frequency. Various charges such as premium allocation, policy administration, fund management, and mortality charges may apply as per policy terms.

Investment Allocation: The net premium is invested in selected funds.

Lock-in Period: ULIP's lock-in period is 5 years as per IRDAI regulations. Partial withdrawals are permitted only after the completion of this period, subject to policy conditions.

Death Benefit: In case of the life insured's unfortunate demise during the policy term, the nominee receives the death benefit as defined in the policy document (e.g., the higher of the sum assured or fund value, or the sum assured plus the fund value, depending on the product design).

Maturity Benefit: On survival till maturity of the insured person, the policyholder receives the fund value, subject to market performance.

Key Features of ULIP Policy

- Combination of life cover and investment.

- The choice of multiple fund options remains in it.

- Fund switching facility is available as per insurer limits.

- It is a long-term financial planning tool.

- ULIP offers transparency through daily NAV declaration.

Tax Considerations

- Premiums may qualify for deduction under Section 80C of the Income Tax Act, subject to prevailing tax laws.

- Death benefits are generally tax-exempt under Section 10(10D), subject to conditions.

- Maturity proceeds on the ULIP policy may be tax-exempt or taxable depending on the premium amount and applicable tax regulations at the time of maturity.

Tax laws are subject to change. Individuals should consult a tax advisor for updated provisions.

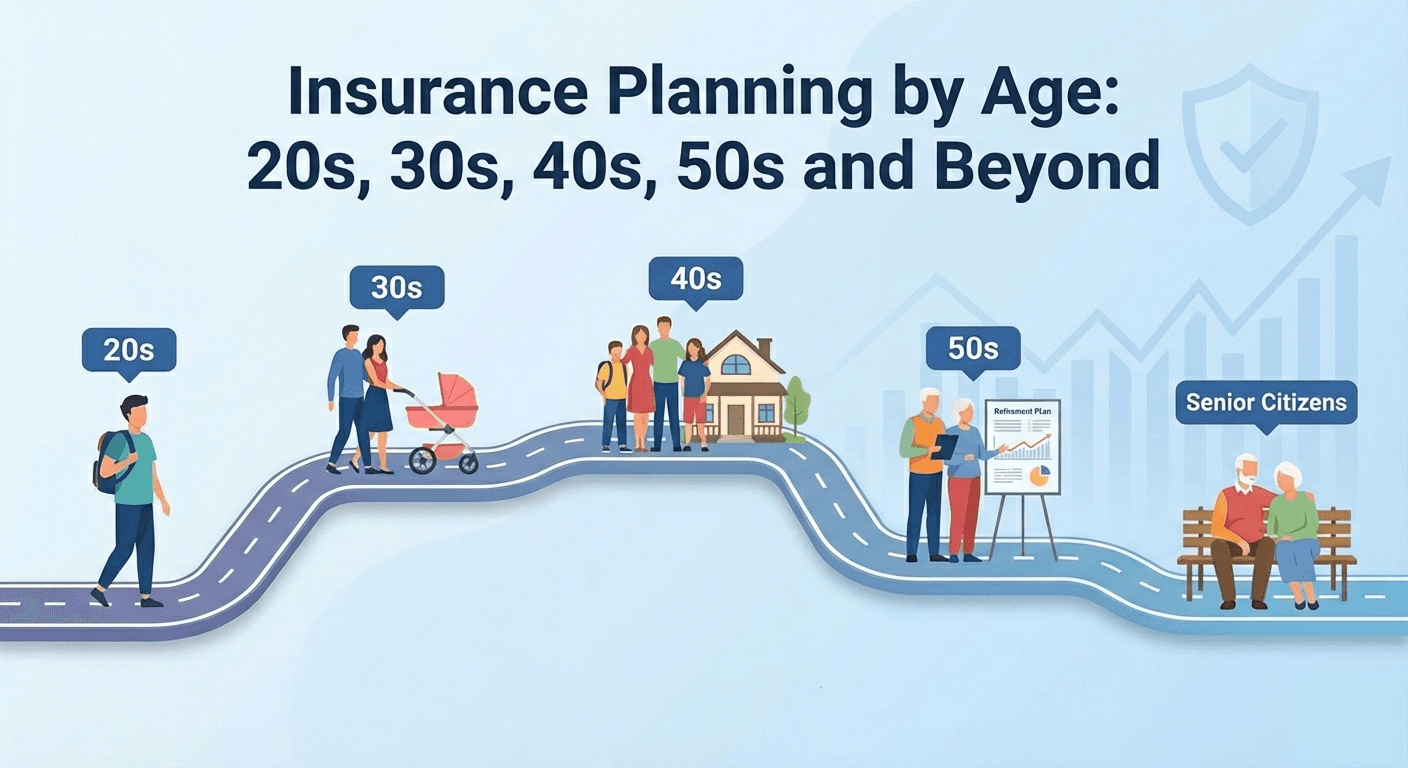

Who May Consider ULIPs?

ULIPs may be suitable for individuals who:

- Have a long-term investment goal, typically 10 years or more.

- Are comfortable with market-linked returns.

- Need life insurance protection along with investment exposure.

- Prefer disciplined investing through regular premiums.

- Are looking for tax exemption benefits.

- Have a long-term investment goal, typically 10 years or more.

- Are comfortable with market-linked returns.

- Need life insurance protection along with investment exposure.

- Prefer disciplined investing through regular premiums.

- Are looking for tax exemption benefits.

Important Considerations While Taking a ULIP Policy:

- ULIPs are subject to market risk.

- Returns are not guaranteed.

- Charges and benefits vary by insurer and product.

- Early surrender before ULIP's lock-in period of 5 years is restricted as per the regulations.

- Investors should review policy brochures carefully.

How Inbest Can Assist

Inbest is a licensed insurance broker that can assist you in:

- Understanding ULIP product structures in detail.

- Comparing all available options from multiple insurers to choose from.

- Explaining all associated charges, fund choices, and policy terms of ULIP.

- Hassle-free documentation and application processes.

Final Thought

A ULIP policy combines life insurance with market-linked investment, making it suitable for long-term financial planning. With a mandatory ULIP lock-in period of five years, it encourages disciplined investing. However, returns depend on market performance, so understanding charges, risks, and policy terms is essential before investing.

Disclaimer: This article is for general informational purposes only and does not constitute insurance advice, solicitation, or recommendation. Policy terms, benefits, and eligibility are subject to insurer guidelines and regulatory provisions. Unit Linked Insurance Plans are subject to market risks. Please read all scheme-related documents carefully before investing.