Key Takeaways

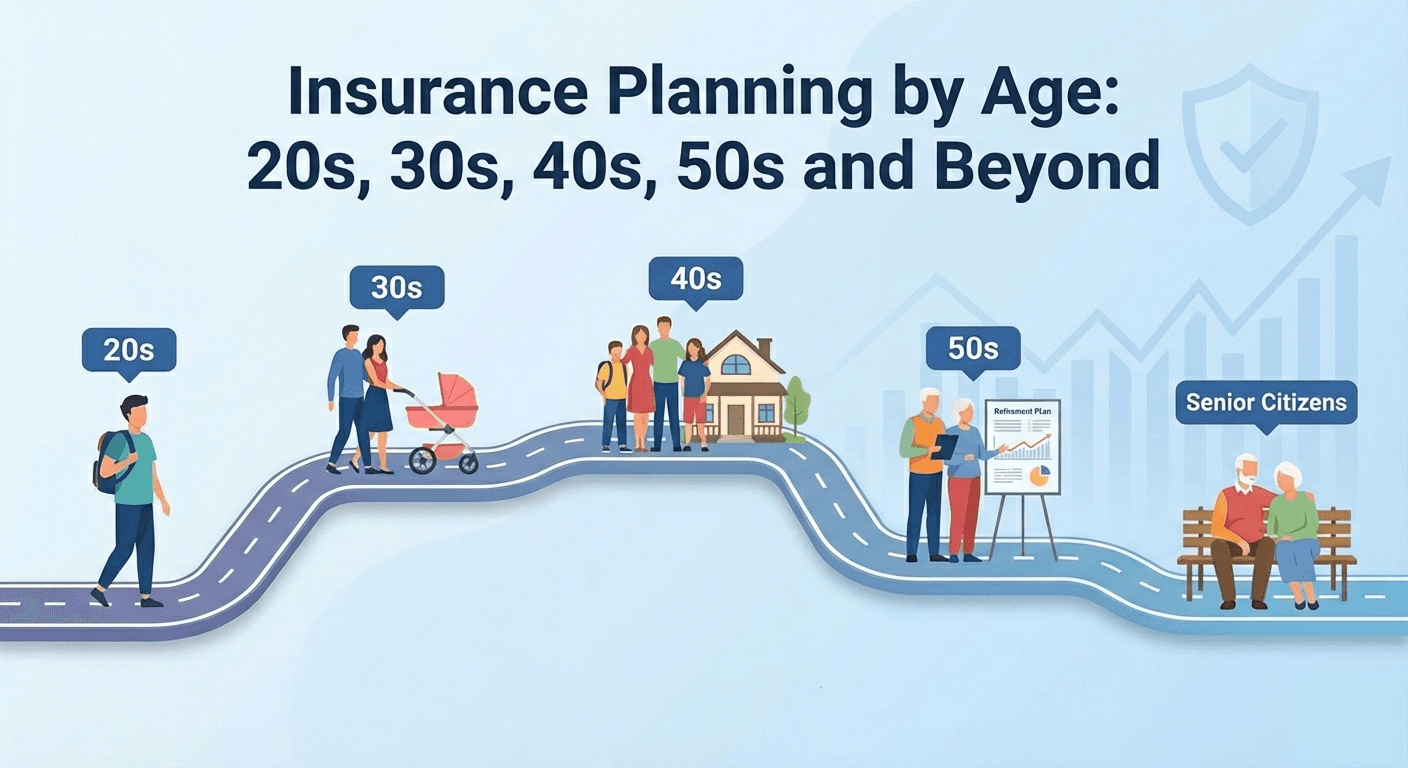

Insurance needs evolve with life stages: lock in low-rate term plans in your 20s, prioritize family floaters in your 30s, and upgrade to comprehensive health coverage by your 40s. In your 50s and 60s, focus on retirement planning and specialized senior health insurance, ensuring full medical disclosure to secure future claims.

Introduction

Insurance planning is not a one-size-fits-all decision. Your income, responsibilities, and health risks change with age, and your insurance strategy should evolve accordingly. A well-structured plan ensures you remain financially protected at every stage of life without overpaying or being underinsured.

This guide explains how your insurance needs change across life stages and how to choose the right mix of protection and financial security, including for senior citizens.

Insurance in Your 20s: Start Early and Build a Foundation

Your 20s are the ideal time to begin because premiums are low and eligibility is high.

You should consider:

- Term life insurance to lock in lower premiums for the long term, based on your expected future responsibilities.

- Individual health insurance to protect against unexpected medical expenses.

- Personal accident cover or rider for financial support in case of accidental disability or death.

Starting early ensures long-term affordability and uninterrupted coverage.

Insurance in Your 30s: Protect Your Family and Goals

In your 30s, responsibilities such as marriage, children, and loans increase. Insurance planning should focus on protecting your family's financial future.

Key priorities include:

- Adequate term insurance to cover liabilities, income replacement, and long-term goals like children's education.

- Family floater health insurance to cover spouse and children under one plan.

- Optional maternity cover, available in selected policies with waiting periods.

- Long-term savings or investment plans such as ULIPs or child plans, based on your risk appetite and financial goals.

Insurance in Your 40s: Strengthen Protection and Manage Health Risks

By your 40s, financial commitments are often at their peak, and health risks begin to increase.

At this stage:

- Review and enhance your term insurance cover based on your current income and obligations.

- Upgrade your health insurance to a higher sum insured to match rising medical costs.

- Consider a critical illness plan that provides a lump sum benefit upon diagnosis of specified serious illnesses.

- Add a super top-up plan to increase overall coverage at a relatively lower cost.

Insurance in Your 50s: Prepare for Retirement and Medical Security

Your 50s are a transition phase toward retirement. Insurance should focus on maintaining financial independence and ensuring healthcare protection.

You should:

- Continue life insurance if you still have dependents or liabilities.

- Strengthen health coverage with adequate base and top-up policies.

- Consider retirement-oriented savings plans that offer disciplined corpus building, depending on your financial goals.

- Maintain continuity of existing policies to retain benefits such as coverage for pre-existing diseases after waiting periods.

Insurance for Senior Citizens (60 and Above)

After 60, insurance planning focuses primarily on healthcare and financial dignity.

Senior citizen health insurance plans offered by insurers may include hospitalization coverage, day-care procedures, and certain treatments such as cataract or joint replacement, subject to policy terms, limits, and waiting periods.

Most health policies offer lifelong renewability as per regulatory norms, provided premiums are paid on time.

Life insurance options at senior ages depend on health, age, and underwriting criteria. Available options may include limited-term policies or whole life plans, subject to eligibility.

Choosing between individual and floater health plans depends on medical needs and premium structure and should be evaluated carefully.

It is essential to fully disclose all medical history and existing conditions, as non-disclosure can lead to claim rejection or policy cancellation.

Why Expert Guidance Matters

Insurance products involve detailed terms, exclusions, waiting periods, and claim processes. Choosing the wrong plan can lead to inadequate coverage or claim issues.

Professional guidance helps you:

- Choose suitable coverage

- Compare policy features

- Understand exclusions and waiting periods

- Get assistance during claims

How Inbest Helps

Inbest offers need-based, transparent insurance planning across life stages. The services include age-wise planning, senior citizen insurance guidance, policy comparisons, personalized recommendations, and support from purchase to claim settlement.

Final Thoughts

The right insurance strategy protects your health, family, and financial future at every stage of life. Whether you are starting your career or planning for retirement, timely insurance planning helps you stay prepared and secure.

Disclaimer

This article is for general informational purposes only and does not constitute insurance advice, solicitation, or recommendation. Policy terms, benefits, and eligibility are subject to insurer guidelines and regulatory provisions.